A checking account refers to a type of bank account that allows you to use your money 24/7. With such an account, you can keep money from your everyday use. You can open a checking account from a bank or credit union. Some mobile wallets allow you to open a checking account for your everyday uses. When opening an account, you must avail various things to get started. But what do you need to open a checking account?

Today, I will focus on the various things that you need for your account opening. These include documents and personal information. The United States federal government requires every financial company to get identification details from everyone opening an account. That way, they can prevent criminals from opening bank accounts. You can imagine how the world would be if terrorists and their sympathizers accessed banking services with ease. The world would be very insecure.

You can either open a checking account online or at a branch. However, opening an account online is more convenient as you can easily and quickly get started with your account. You do not have to line up at a branch and waste all your time photocopying and filling in forms. Once you fill in all the spaces and submit the required documents, you can then wait for communication in your email or phone number about the status of your account.

What do you need to open a checking account?

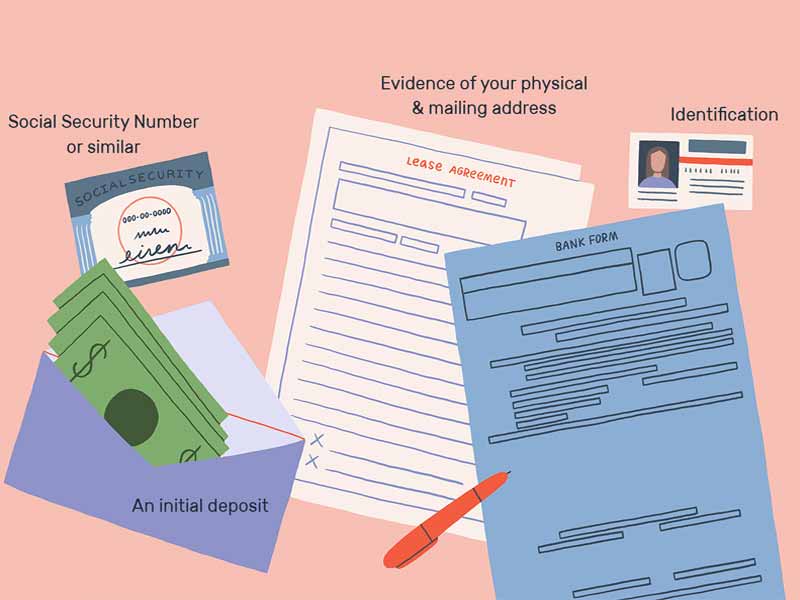

Opening a checking account requires various things for it to be approved. The following are the things you need to open a checking account.

i) Social Security Number (SSN)

A Social Security number (SSN) refers to a nine-digit number that the U.S. federal government issues to the eligible U.S. residents who apply for one. The number is helpful to assist the government to track the number of years you have worked to be able to give you your social benefits and other government services. In short, the SSN allows the government to track individuals’ financial information.

You should always keep the number in a safe place and never give it out anyhow. Some fraudsters can use your Social Security Number and your identification document to open bank accounts in what we call identity theft. The Social Security Administration protects your SSN and keeps the records confidential. They only give out the number when authorized by law.

ii) An identification document

An identification document helps to ensure that only genuine Americans open an account. That way, criminals such as drug traffickers, terrorists, and money launderers do not get a chance to open a bank account. Together with your Social Security Number, they help banks to only register bank accounts to responsible citizens.

There are various forms of identification documents that you can have. They include passports, drivers’ licenses, and government identity cards. Even after opening your bank account, you will always require an identification document to carry out various transactions. For example, you require your identification document to withdraw money from a checking account at a bank or credit union branch.

iii) Phone number

You require a phone number when opening a checking account or any other type of bank account. A phone number is helpful to help your bank to communicate to you when there is an urgent need. Some mobile wallets also utilize the phone number when it comes to transfering money. For example, when on Venmo, you can send money to others using their phone numbers. You have to verify your number as well when opening an account.

iv) Email address

Whenever opening an account, whether online or at a physical store, you must provide an email address. It will be helpful to receive detailed communication from your bank or credit union that cannot be sent to your Mobile phone number.

Banks can only send you monthly statements, news about your bank, and so on via your email address. Your bank or credit union will always require you to verify your email address, especially when opening a checking account online. The most preferred email addresses are from Yahoo and Gmail.

v) Physical address

You require a physical address when opening a checking account, as this is where your bank will be sending your monthly statements and any mail correspondences. Even though nowadays banks send e-statements to email addresses, they have to get a physical address from you to satisfy the federal government’s requirements.

How do you open a checking account?

As I mentioned earlier, you can open a checking account online or at a branch. Whether opening a checking account with no ChexSystems or with ChexSystems, you have to check various checking accounts from various banks to know which one suits you. The following are the factors to consider before settling for any bank account.

- Monthly maintenance fees

- Minimum account opening balance

- Foreign transaction fees

- Daily withdrawal limit

- Online account management

- Annual fees

Getting a checking account with fewer fees is recommended to ensure that you do not lose a lot of money in the process. Once you have determined the correct account from your bank of interest, you can open your account. You have to gather all the requirements before you can get started.

During your account application, you will get forms whereby you will fill in your details such as your first and last names, your ZIP code, State, City, and so on. You will also need to provide and verify your phone number and email address.

Documents such as the identification document, the Social Security Number, and proof of your physical address will need to be uploaded. By the way, you will need to prove your physical address by submitting documents such as your recent monthly bank statements, electricity, water, internet, or any other applicable statement.

Once you have presented all the details, you can submit photocopies of the relevant documents for verification. As I mentioned earlier, you can take photos of your original documents and upload them as per the guidelines when applying online.

There are various free online checking accounts with no opening deposit that you can open with your phone within a few minutes. Remember, I mentioned minimum opening deposit as a vital factor to consider when opening an account.

How do I use a checking account?

There are various ways you can use your checking account. These include the following.

1) Buy goods and services

A checking account is essential when it comes to buying goods and services. You need the checking account number of the recipient when paying someone with an account in the same bank like yours. If paying a merchant of a different bank account, you will require their routing and account numbers to carry out an ACH or wire transfer. You can even use a debit card that comes with a checking account to pay for goods online and at physical stores.

2) Send money

You can send money with a checking account number instantly to account holders of your bank. Alternatively, you can send money to account holders of other banks using routing and account numbers. The ability to move money from one person to another while far away maintains a proper circulation of money.

3) Save money

Some checking accounts allow you to save money and earn interest. You should maintain a certain balance to be able to earn interest. For your information, if you come across a checking account that allows you to earn interest, then the interest is usually higher compared to ordinary checking accounts. You can even get an APY of 1.0% or more!

4) Withdraw money

A checking account helps you withdraw money from your account either over the counter or at an ATM point using a debit card. Checking accounts come with debit cards that you can use for your transactions. You can easily open an online bank account with an instant debit card. Instant debit cards are usually virtual, and you can use one as you wait for the ideal card.

5) Receive money

Apart from sending money to others, you can receive funds in your account. Others can transfer money to your account so long as they have the necessary details of your account. You can receive your salary in your checking account if you are employed.

You can get a direct deposit form from your employer and fill in your routing and account numbers in the appropriate spaces. Bank accounts can help you to receive government benefits via direct deposits as well.

Do I need credit scores to open a checking account?

You do not need to have credit scores when opening a bank account. However, most banks require you to have a positive banking history if you have ever opened a bank account. To record a good banking history, you have to write checks that you are sure will not bounce, close accounts only when you have cleared your debts, and never use your account for fraudulent transactions. Otherwise, banks will report you to the ChexSystem, a body that lists poor bank account users.

Can I get a checking account if I am in the ChexSystem?

Yes, you can get a second chance checking account to help you regain your lost glory. You can even get a second chance of checking with no opening deposit from various banks.

Bottom line

A checking account refers to a bank account that allows you to use your money 24/7. You can use a checking account to keep funds that you can use for your everyday expenses. Again, you can open a bank account online or at a branch. Also, you can use a checking account to buy goods and services, send, save, or withdraw money.