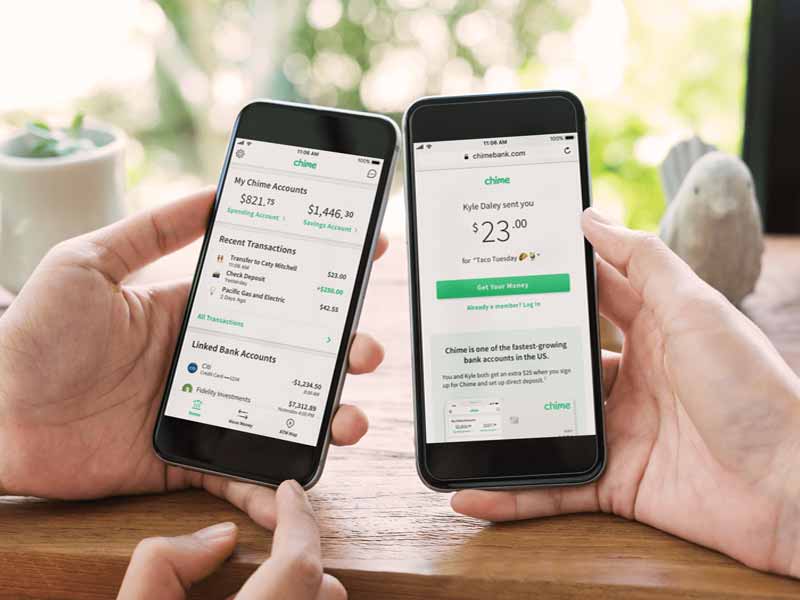

Chime is an American online bank that provides fee-free financial services through a mobile app. It has millions of account holders, which makes it one of the US’s major banks. If you have a bank account with Chime, you can transfer funds to accounts in other banks or to mobile wallets such as Cash App, whereby you need to understand how to transfer money from chime to cash app without debit card or even using a Chime debit card and so on.

Chime bank operates purely online since it does not have a physical branch. Users can use their mobile phones or computers to access their accounts online and carry out various transactions. You can deposit checks, send money, pay bills, pay your employees, and so on. Online banks save a lot of money which they could have used to rent physical branches. One central office is enough to run the business online.

Cash App is also an online financial company that operates as a mobile wallet. It is a peer-to-peer app by Square that allows friends and families to send and receive money. Using the Cash App, you can pay bills for electricity, water, internet, and rent, among others. You can top up your Cash App account using a debit card, credit card, or even a bank account.

How to transfer money from Chime to a Cash App without a debit card

You might be wondering whether it is possible to transfer funds from Chime bank to Cash App. Well, it is possible. You can top up your Cash App account using Chime balance to use for various kinds of transactions. For a successful transfer of money from Chime to Cash App, the following procedure is useful.

i) Open your Cash App

On your smartphone, open the Cash App to access your account online. If you do not have a Cash App, you can get it from the Google Play Store for Android smartphones or get it from the App Store if you are using iOS. Alternatively, you can log in to your Cash App account on a desktop browser.

ii) Navigate to your profile

You can access your profile details by tapping your profile picture. Here, you will be able to see your balance as well as the card or a bank you have linked to your Cash App account. If you have not connected your Chime Bank account, you can link it at this point. If using a desktop browser, you can move to your profile and see the option to add your Chime Bank account.

iii) Add Chime Bank account

Click on the ‘Add Bank Option’ and see the various banks you can add to your account. Select Chime Bank. A prompt will come up with the Chime Bank login screen requesting you to log in to your Chime account to allow the transfer of money to or from your Cash App account.

When logging in, ensure you enter your details keenly to avoid flagging due to suspicion. Once you have successfully logged in to your Chime Bank account, you will see Chime bank in your banks’ list in the Cash App.

iv) Confirm whether it is working

Before initiating a large amount transfer, you need to confirm that it is working. Transfer $1 from Chime to Cash App and see whether it will reflect in your balance.

You can also try transferring it back to Chime to be completely sure that the linking was successful. Transfer of money from Cash App to Chime can take between 1-3 days. The same applies to the transfer of funds from Chime to the Cash App. There are no fees to transfer money from chime to Cash App and vice versa.

However, it is possible to make instant deposits from Cash App to a linked Chime Debit card. Instant deposits cost you a 1.5% fee (minimum fee – $0.25). Money reflects in your debit card instantly. When you are now sure that you can transfer money successfully from Chime to Cash App, you can then move a larger amount per your needs.

What is the process of opening a Chime Bank account?

If you do not have a Chime bank account, you need to open one online to use it with your Cash App. Since Chime is a typical bank, you will need to produce all the necessary materials just like others. These include,

- Government ID

- Social Security Number (SSN)

- Physical Address

A government ID helps to identify who you are. Since a bank account is a medium where money will move, the bank account owner must account for all transactions. The move helps to prevent illegal usage of funds such as illegal drug business transactions or funding terrorists. A national ID card, passport, driver’s license, or military ID is some of the Government Identification Documents.

The Social Security Number helps to track your lifetime earnings and years worked to determine your retirement benefits. The number is significant, and one should protect theirs from identity theft since some people can use the number for fraudulent activities.

It is crucial to note that, apart from free checking account no credit check no deposit, you can use a Social Security Number to;

- Apply for a Federal Loan.

- Get a Public Assistance program such as social security disability income and unemployment benefits.

- Apply for medicare

- Apply for a passport

- Get a driver’s license.

- To get a passport.

A physical address helps to identify the real place where you live so that you can receive statements and any other mail correspondences. A physical address is necessary because you can receive unrestricted mail and parcels.

Once you have all the documents, you can then proceed to open your Chime Bank account online by visiting the Chime account opening section to get started. A form will appear for you to enter;

- Your first and last name

- Social security number (SSN)

- Email, and

- Password

Chime Bank will review and confirm your details if they are genuine. You must also be at least 18 years old and be a US citizen. Once your account is operational, you can download the Chime app from the relevant sites or visit the Chime website on your PC browser.

Is chime a reliable bank?

Chime is a very reliable bank you can have. First of all, it is purely online, and this means that it is very convenient. You can access your bank account anywhere and at any time. There are other reasons why having a Chime bank account is beneficial. These include;

i) No hidden fees

Chime does not have monthly fees or overdraft fees. There are also no foreign transaction fees whatsoever. It is a very friendly bank where you will see the value of your money. The movement of funds from the bank to your Cash App account is also free.

ii) Free ATM access

With a Chime bank account, you can withdraw money for free at 38,000+ fee-free Visa plus Alliance ATMs and MoneyPass®. However, out-of-network fees must apply.

iii) No monthly minimums

You will not need to maintain a certain amount in your account. You can have even zero amount and no penalties on that. It means that if you receive a certain amount of money, you can decide to withdraw all of it for your intended use.

Does Chime have a debit card?

The Chime Spending Account comes with a debit card that you can use anywhere where they accept Visa. The debit card has no monthly fees, nor does it have minimum balance requirements. Replacement of the card is also free if, in any case, you spoil or misplace the current one.

Apart from withdrawing money at ATMs, you can use the card for mobile payments. You can even integrate with apps such as Apple Pay™ and Google Pay™ for convenience. Thus, there is no need to carry vast amounts of money in your pockets for regular spending since your card does everything!

Interestingly, the card allows you to save something. Chime rounds up to the nearest dollar and transfers the round-up from your Spending Account into your Savings Account any moment you swipe your debit card. You can thus save something substantial over a particular period in such a magic manner.

Just like you can link a chime bank account to a Cash App, you can as well connect your Chime Debit card to your Chime account to fund your Cash App transactions.

What are the Cash App fees and limits?

There are some scenarios where Cash App charges fees while it does not rely on others. When sending money from your account to another Cash App user, there are no fees involved. The sending is free of charge.

Moreover, when withdrawing money into a bank account, the process is free if you follow the standard withdrawal process that takes 1-3 days to complete. However, when making instant withdrawals into your bank account, there is a fee of 1.5% that applies. Money can appear in your bank account instantly or within a few minutes.

A Cash App account can be verified or unverified. For unverified Cash App accounts, the maximum amount you can send per week is $250 while the maximum you can receive is $1,000 within 30 days. Such a Cash App account has unverified details such as your full name, physical address, and Social Security Number. For verified accounts, the maximum amount you can transfer is $2,500 in a week.

How do I use money in a Cash App?

There are various ways you can use the money in your Cash App account. These include the following.

1) Payment of bills

Cash App is a mobile wallet, and you can use it to pay bills online. You need your account and routing numbers for the activity. When paying for bills, your service provider bank will ask for your routing and account number to complete the process.

Alternatively, you can use a Cash App debit card if you have it. It operates like regular debit cards whereby you can swipe to pay or provide the card details where possible. The card uses your Cash App balance.

In most cases, you add the card to a payment platform and initiate an autopay weekly, fortnightly, or monthly depending on your payment schedule. A Cash Card is free to order, and you can have it any time you want it.

2) Sending to others

You can transfer money in your account to other users such as your family members and friends. To send money, the following procedure is useful.

- Open your Cash App

- Enter the amount to send

- Tap ‘Pay’

- Enter the email address, and phone number of the recipient. You can even add their ‘$Cashtag,’ which also works well.

- Write the reason for payment.

- Tap ‘Pay’

The recipient should be able to get the money if you entered the correct details. Note that you will not cancel a transaction once you tap ‘Pay,’ and thus, you should ensure that all details are correct. Cash App to Cash App transfers is free.

3) Withdraw

You can withdraw funds from the Cash App account into a bank account. If you have linked a bank account such as Chime, then you can always withdraw money to your bank. You can either perform instant withdrawals at a fee or use the standard way that takes 1-3 days.

Moreover, you can withdraw money from your Cash App account in an ATM using your Cash Card.

Does Cash App work internationally?

Cash App works internationally. However, it is crucial to note that only international users in the UK can use Cash App. Other countries apart from the US and UK cannot use the app for various transactions.

When you send money to a Cash App user in the UK, Cash App converts it from USD to GBP based on the current exchange rates. The recipient in the UK thus gets the money in GBP. Cash App transfers from the US to the UK are free.

Bottom line

You can transfer money from a Chime bank account to a Cash App account with ease. You only need to link your Chime Bank account with your Cash App, and you are good to go. You can also add a payment card to your Cash App account to fund various transactions. You can use Cash App money for several types of transactions such as bill payments, ATM withdrawals, or sending to others.