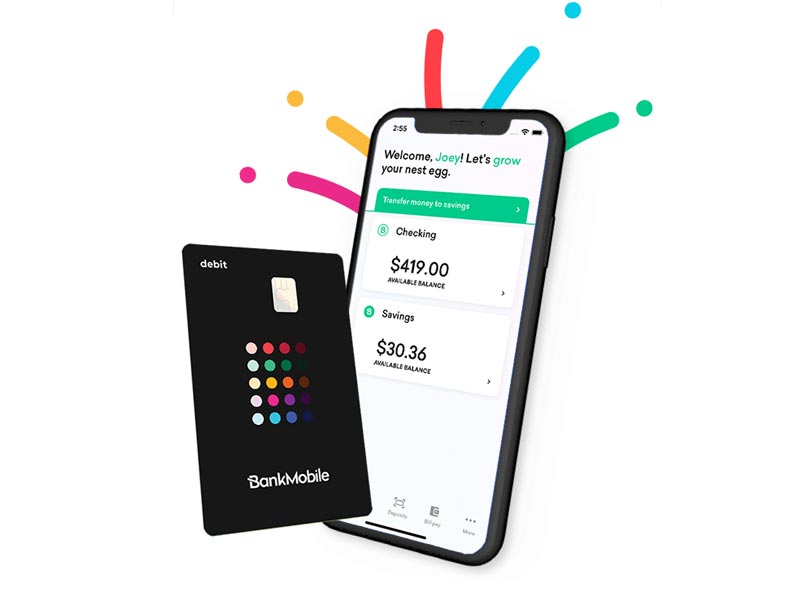

BankMobile is a financial company that offers a mobile banking app with branchless banking services and no fees. The company’s headquarters is in New York City. It started its operations in 2015 under the leadership of Jay Sidhu and Luvleen Sidhu. There are various transaction activities that you can do with the company. Today, we shall learn how to transfer money from BankMobile Vibe to another bank.

Transferring money from one institution to another is very important since it allows money circulation. Businesses can quickly receive payments from their clients, while employers can pay their workers without much hassle. Transfer of money can happen online or at physical branches. Since BankMobile is an online financial company, transfers have to occur online or in the mobile app.

We have several ways which you can use to transfer money from one financial company to the other. They include wire transfer, ACH, third parties such as PayPal, Venmo, Payoneer, etc. You can also transfer money using a check. A check is a written document that allows financial institutions to get money from the writer’s account and give it to the beneficiary or deposit it into their accounts.

Things You Can Do With Your BankMobile Account

There are various transactions that you can do with your BankMobile account. First of all, you can transfer money to someone else’s bank account using the routing and account numbers of the receiving account. Also, you can make your purchases online to pay for various services and goods.

As a student, you can find the bank very helpful since buying goods and other things to support your studies is easy. The company believes that your money should work for you and not the other way around.

Therefore, your BankMobile Vibe Up Checking Account allows you to earn up to 0.50% Annual Percentage Yield (APY) as a way to pay you back on balances up to $15,000.99. Again, you can earn interest by simply using your BankMobile Vibe Up Debit Mastercard® card.

Talking of the BankMobile Vibe Up Debit Mastercard® card, you can easily withdraw money from your account at various ATM points when you need cash. ATMs are very convenient for getting funds for your everyday use. Remember also that you can use the ATM card to buy things online or at a physical branch.

To earn the interest mentioned above, you should spend at least $300 per statement cycle on your daily point-of-sale purchases such as groceries, online shopping, gas, and more using your BankMobile Vibe Up Debit Mastercard® card.

At the end of a statement cycle, BankMobile will look at your qualifying transactions and utilize your average ledger balance to determine your earned interest and apply it to your account.

Features Of A BankMobile Account

Once you open your account, you will be able to enjoy various features, which include the following.

i) Allpoint® ATMs

The bank allows you to withdraw money from over 55,000 fee-free Allpoint® ATMs worldwide. Therefore, you do not have to stress yourself about where you can withdraw money from your account once you travel abroad.

ii) Budgeting

Once you start using the institution’s services, you will get convenient budgeting tools. You will be able to manage finances either from a desktop with Money Meter or from your phone with SnapShot.

iii) Mobile check deposit

It’s easy to deposit your checks with your mobile app. You only need to log into your account, take photos using the Mobile Check Capture and deposit anywhere. Checks are among the best ways to transfer money between banks.

Once you write your check, the beneficiary only needs to take the check to their bank to deposit it in their account. The concerned bank will then facilitate debiting money from your account and crediting the beneficiary’s account.

iv) On/off feature for your debit card

You can quickly secure your card to prevent unauthorized usage when you lose or misplace it. Remember that someone can use your card even if they do not have your PIN. They only need your card number, the expiry date, and the CVV to make payments. Therefore, you can use the BankMobile account to switch your Mastercard® debit card on/off.

v) Bill Payments

Since your BankMobile account operates like any other bank, you can make your payments easily anytime, anywhere, and no paper cuts or stamps are required. Also, you can set up auto payments so that even if you forget, your payments will still succeed.

That way, you will continue enjoying services all through. Some of the bills you can pay using the platform include water, electricity, internet, among other necessities in your life.

Different Ways To Add Money To Your BankMobile Account

There are various ways you can add money to your account. They include the following:

1) Transfer money from an external bank account

It is possible to transfer money using the routing number and account number of your BankMobile account using another bank account with ease. You only need to log into the other account online and transfer money using either wire transfer or ACH. You can also give others your account details so that they can send you money.

2) Use direct deposit

You can easily enroll for direct deposit from your employer or government benefits agency and receive funds in your account two days earlier than the traditional banks. You only need to download the direct deposit form, fill it out and submit it to your employer.

3) Reload at the register

You can add funds at various reload centers up to $500 at a fee. You need to visit the nearest reload location and have a fee of around $4.95 with you.

4) Deposit a check

You can deposit checks online. Remember that is one of the features that I discussed earlier. Online check deposit is easy since you only need to log in to your account and use the check capture feature to upload your endorsed check. After the processing is over, the balance will display in your account.

Transfer Money From BankMobile Vibe To Another Bank – The Method

BankMobile allows you to receive money from other banks to top up. The question is, can you transfer money from the BankMobile Vibe to another bank? The reality is that you can transfer money from your BankMobile Vibe account to other banks using their routing and account numbers.

You can move funds by wire transfer at a $25 fee. The maximum transfer limit to your external bank account is $10,000, while the maximum transfer limit for moving to another person’s bank account is $1,000.

Final Words

BankMobile is a financial institution that offers a mobile banking app that offers branchless banking services. The company’s headquarters is in New York City. It started its operations in 2015 under the leadership of Jay Sidhu and Luvleen Sidhu.

It mainly targets students who can benefit from various features online. There are various kinds of transactions that you can do with your account, such as bill payments, sending money, and saving money, among others.