Cash App is one of the best applications for sending and receiving money in America. The app allows you to load or fund your transactions from various sources, such as debit cards and prepaid debit cards. You can also load your Cash App account using your bank account. Today I want to tell you secrets of transfer money from bank to Cash App.

You may be wondering whether Cash App is a bank or not. Even though Cash App requires similar information like banks when opening an account, it is not a bank but a digital wallet. Users require a unique name that starts with $Cashtag that others can send money to. You can also use the $Cashtag of someone else to request money from them.

When you study Cash App closely, you find that the app is a social platform for exchanging money. When you receive funds from others, you can use the balance to buy goods and services online, send to others, or withdraw money at an ATM using the Cash App Cash Card debit card. The card also allows you to purchase goods and services at physical stores and service centers.

Process To Open A Cash App Account

You can open a Cash App account right from your mobile phone or desktop. You must be at least 18 years old and living in America. You will also need to have the following to get started.

- A smartphone or computer

- Phone number or

- Email address

Later on, you will require the following details for account verification.

- Identification documents such as passport, Driver’s License, or ID card

- Social Security Number (SSN)

- Physical address

Once you get all these requirements, you can download the Cash App from the Google Play Store using an Android device or from the App Store when using iOS devices. Next, open the app and enter your preferred email address or phone number to proceed. The email address or phone number must be active since you will have to enter a verification code sent to your email or the phone number.

After verifying your phone or email address, you can then add a bank account or debit card. When adding a bank account, you should enter the debit card that links to your bank account. You should never add a credit card since it will not work. Note that you can even skip adding a bank account and choose to add it later.

The next thing is to choose your $Cashtag that will serve as your user name. It should contain at least one letter and at most twenty characters. Friends and relatives will be using the username to send money to your account.

A new account is always restricted and cannot allow you to transfer much money to other Cash App customers. You will have to verify your Cash App account by providing the necessary information to the Cash App. However, you will be able to add a bank account to your restricted Cash App account.

Services Of Cash App

Cash App gives you lots of tools so that you can perform various kinds of transactions. Cash App allows you to perform the following:

- Buy Bitcoin

- Send and receive funds instantly

- Earn rewards

- Receive payments via direct deposit

- Add cash into your Cash App account

- Sign up with an existing debit card

Remember what I mentioned up there that you can also request a debit card to withdraw money from an ATM. The Cash Card also allows you to pay for goods and services at stores that accept card payments.

Send Money Via Cash App – The Steps

Cash app allows you to transfer money to other Cash App users using their phone number, email address, or unique $cashtag. To send money to someone else, you should use the steps below.

- Log into your Cash App mobile app.

- Enter the amount of money to send.

- Hit “Pay.”

- Enter your phone number, email address, or $Cashtag of the recipient

- Write the reason for sending the money

- Tap Pay.

You can send up to $250 within any seven days when you have an unverified account. You can increase the limits once you verify your account. Additionally, you can receive up to $1,000 within any 30 days with an unverified account, of which the limit increases upon the account verification. As I mentioned earlier, you can request someone to send you money using their $Cashtag.

Cash App also allows you to add money to your account using a bank account or debit card. You have to link your bank to Cash App to use the bank balance to fund your Cash App transactions. Also, you can transfer money from Cash App to your bank account when the need arises.

Method To Transfer Money From A Bank Account To Cash App

A bank account is one of the sources you can use to load your Cash App account with money. Cash App supports almost all major banks of the US, and there is a possibility that your bank account will be accepted. Even online banks such as Chime allows you to top up your Cash App account.

You can even transfer money from Chime to a Cash App without a debit card. Since you have to initiate the transfer of money from your bank account to your Cash App account, you need to understand how you can carry out the process step by step. You should follow the guidelines below:

- Hit on the ‘Banking tab’ on the home screen

- Select ‘Add Cash’

- Choose an amount to add to your account

- Select ‘Add’

- Authorize with your Touch ID or PIN

I am assuming that you already added your bank account during the account opening. If you have not added it, then you can add it by following the steps below.

- Hit on the ‘Banking tab’ on the home screen

- Choose ‘Link Bank’

- Follow the prompts

You can also opt to change or modify your bank account by following the procedure below.

- Hit on the ‘Banking tab’ on the home screen

- Tap ‘Linked Banks’ or ‘Linked Accounts’

- Select the account you wish to modify

- Choose ‘Remove’ or ‘Replace Bank’

- Follow the prompts

Adding money to your Cash App from your bank account takes between 1-3 business days. The duration taken to transfer money varies from one bank to the other. The more you use your bank account to recharge your Cash App account, the more Cash App gets used to it, thus lowering the duration taken for the funds to reflect in your account for the subsequent transactions.

Procedure to Move Money From Cash App To A Bank Account

You can transfer money from Cash App to a bank account. If, for example, you receive payments from your employer, you may find it necessary to transfer money to a bank account for various reasons.

Likewise, when having online accounts with financial companies such as Chime and Ally Bank, you will at one time need some money in your brick and mortar bank account. Each online bank gives you a procedure to withdraw your funds to a regular bank account.

For example, when moving money from a Chime bank account, you need to know how to transfer money from Chime to a bank account.

Some of the major reasons you can move money from your Cash App to a bank account include the following.

- For savings

- For your checking account automatic payments

- To pay loans

- Recharge your debit card

- To write checks

- When closing your Cash App account

You should follow the steps below to move money from Cash App to a bank account.

- Hit on the Balance tab on your home screen.

- Select Cash Out.

- Choose an amount and hit Cash Out.

- Choose a deposit speed.

- Confirm your transaction with your PIN or Touch ID.

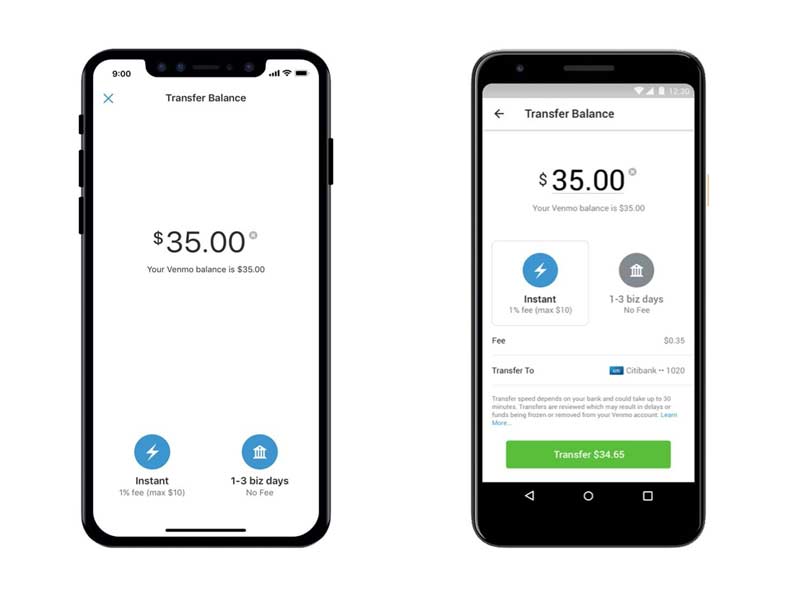

Cash app has two main types of deposit speeds. You can use the instant or standard transfer. The instant transfer works with debit cards and ensures that funds are available in your debit card instantly. The instant transfer method is subject to a 1.5% fee. The transfer method is suitable to move emergency funds to your bank account.

You have to wait for around 1-3 business days for the funds to reflect in your bank account for the standard transfer option. The transfer method works with banks, unlike the instant transfer that works with debit cards only. Despite the method used, money eventually arrives in your account.

Can I Cancel A Cash App Transaction

You cannot cancel an instant transaction. However, you can request the recipient to refund you the money. For example, when you send money to another Cash App account holder, you can tell them to refund you using the procedure below.

- Tap the ‘Activity tab’ on the Cash App home screen

- Hit the ‘Payment ‘in question

- Select ‘Refund’

- Press ‘OK’

The money will be back in your account within a short time. You can even use the request option to ask the recipient to send the money back to you. Furthermore, if you request instant transfers and the transfer does not happen instantly, Cash App will refund your instant transfer fees.

Summing Up

Cash App is a payment service that allows you to send and receive money via an app. You can use Cash App on your mobile phone or desktop. Cash App also allows you to transfer money to a bank account. You can also move money from a bank account and fund your Cash App transactions. Furthermore, Cash App allows both instant and standard transfers. You cannot cancel instant transfers, but you can request a refund from a recipient.