The Bank of America is among the largest banks of America that serve millions of Americans. It has various kinds of bank accounts that you can open for your financial quest. There are various ways you can use a bank account from the Bank of America. Today, I will explain the method to send money from Bank of America with the routing and account number.

At the Bank of America, you can have a checking, savings, CD, or IRA. A checking account helps one to deposit money for everyday uses. A savings account allows people to save money for future use, while CD accounts allow you to lock your funds to withdraw on a future date when the funds have gained interest.

In most cases, people open bank accounts to save funds for the future. The bank of America allows you to open a bank account either online or at a physical branch. Online account opening is more convenient since you only need an internet-enabled device to carry out the process. You also need to have the vital documents to open an account as per the federal government guidelines.

Open A Bank of America Bank Account – The Process

The process and the requirements of opening a bank account are the same for all bank accounts. Whether opening a checking account, a savings account, or a CD account, you will need the Social Security Number, email address, a physical address, an identification document, and a phone number. The bank of America may require other things, and you should provide upon request.

You can open an account with the Bank of America online or at a physical branch. The online account opening requires a secure internet connection and an internet-enabled device, plus the documents I have mentioned above. You will also need to fill in other details such as your full name, ZIP code, State, and City. Documents such as the identification document, Social Social security Number, and proof for your physical address require you to upload them.

Once you have filled everything as per the guidelines, you only have to submit the details, and you are good to go. The bank officials will then send a message either in your email or phone telling you about your account application status. When applying for your account at a branch, you will fill in all forms and submit your original documents plus photocopies. Once you finish, your account will be ready for various kinds of transactions. You will be able to transfer money using the routing number and account number.

About Routing And Account Numbers

Some people get confused when they hear about routing and account numbers. The two numbers are different and are very important when transferring money from your bank to another bank.

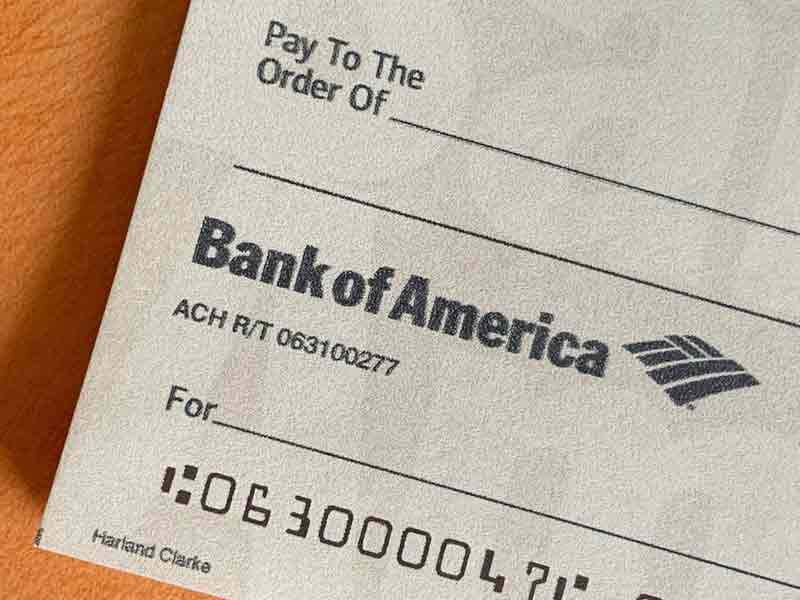

Well, a routing number refers to a nine-digit number that identifies where you opened your bank account. In short, a routing number identifies your bank in detail. There are hundreds of banks and credit unions, and if banks are not uniquely identifiable, it can be challenging to move money across banks.

On the other hand, an account number identifies a customer in a specific bank. When you open an account with the Bank of America, you get an account number to attach your deposits to the number. Others in your bank can transfer money to your account using the account number. An account number usually has 12 digits.

Ways To Send Money From The Bank of America With Routing And Account Number

A routing number allows you to send money to other banks. That means you can use the routing numbers to transfer money from the Bank of America to Chase or any other bank. The following are ways you can send money from the Bank of America using the routing and account numbers.

1) Wire transfer

You can use the routing and account numbers when setting up a wire transfer. Wire transfers allow you to send large amounts of money electronically to recipients in other banks. You can initiate a wire transfer online by using your phone. All you need is to navigate to the money transfer section, then enter the necessary details. You will need to enter the account and the routing numbers of the recipient. And you can then choose the currency to use to transfer the funds with.

You can use wire transfer to send money domestically or internationally. Domestic transfers take a shorter time compared to international transfers. Under normal circumstances, the delivery period is usually one day or less. Again, wire transfers attract some fees which vary based on the institution. However, the transaction costs could be free depending on the type of account you have. Other financial companies may also charge fees for receiving wire transfers. Furthermore, the transfer rates may increase when sending the money to someone outside the United States.

One crucial thing you should note with wire transfers is that they may be irreversible. Once you hit transfer, the funds move immediately. However, with the Bank of America wire transfer, you may be able to reverse the transaction, especially if the recipient has not claimed the money. Wire transfers are handled by the banks and are very convenient when transferring large and urgent funds.

2) ACH transfer

ACH transfer is another way to move money from your bank account to another bank using the routing and account numbers. The transfer process is different from the wire transfer in that the funds have to pass through the Automated Clearing House. Here, they undergo some scrutiny to check the source of funds before they are transferred to the concerned bank. Banks and other financial companies use ACH for electronic funds transfer (EFT), which transfers money to the recipient’s bank online.

ACH transfers are usually for domestic low-value payments between participating financial companies. The transfers are usually free, unlike the wire transfers that charge you some fees. Unlike wire transfers, ACH transfers take longer, and the recipient can get the funds on the third business day after the fund’s transfer is initiated.

ACH transfers are safer than wire transfers because you can easily cancel a transaction once you have entered the wrong details. For wire transfers, you can lose your money if you send money to the wrong person. Above all, ACH transfers may support credit and direct debit transfers. Therefore, you can use the Bank of America to transfer money from a prepaid card to a bank account.

Other Ways To Transfer Money From The Bank of America

There are other ways you can transfer money from the Bank of America. These include the following:

i) Zelle

Zelle is an online money transfer platform that allows you to transfer money from one bank or credit union to the other. It is a fast, safe and simple way to send funds to friends, family, and other people that you trust. Various banks support Zelle, including the Bank of America. The platform integrates with the online banking apps and websites of the supporting banks, and if your bank supports Zelle, the platform is automatically in your banking app.

Zelle requires you to enroll on the platform before you begin to send money to others. You only need to use the contact information of the recipients who should also be enrolled in Zelle to send money. Delivery for the funds is usually in minutes using the recipient’s email or U.S. mobile number already enrolled with Zelle.

In short, Zelle facilitates faster and safe wire transfers. The only problem with the transfer service is that it cannot help you make a Bank of America international wire transfer. You will need to use the bank’s international transfer service or use international wire transfer agents such as MoneyGram and Western Union.

ii) Send check

The Bank of America allows you to send a check. You can use your online banking platform to organize a check to send to the preferred recipient. Not everyone likes receiving money electronically, and thus a check becomes the alternative. At the Bank of America, you can have a personal or cashier’s check. A personal check will reach the recipient, who will go to cash, and then the amount is deducted from your account. It can take several days to process a personal check.

The cashier’s check requires you to pay first before getting the check and makes the check processed by the recipient bank faster. Once the recipient receives the check from the bank of America, they can either cash them online using the mobile app or take them to their branch.

iii) PayPal

PayPal is a money transfer platform that allows you to transfer funds both domestically and internationally. It can be an appropriate avenue for using the Bank of America to send money internationally.

Summing Up

The Bank of America is among the most significant financial companies in the U.S. You can use the bank to transfer money domestically and internationally. International money transfer requires you to have the routing and account numbers of the recipient. The bank supports both wire and ACH transfers. ACH transfers usually are for small domestic transfers, while wire transfers are suitable for large domestic and international money transfers.