Cash App is among the best peer-peer money transfer apps in the United States. The platform also operates in the United Kingdom, whereby users can send money between the two countries. When sending money to the UK from the US, Cash App converts the funds into GBP, the local currency of the United Kingdom. The same applies to when sending money from the UK to the US. The funds have to be converted to USD. Today you will know how to cash out on Cash App.

Apart from sending and receiving money from others, there are various ways you can use Cash App, as we shall see shortly. The platform is suitable for both personal and business use. It has replaced the need for traditional banks since most things you need in a bank are available in the service. For example, you can deposit checks, receive direct deposits, buy goods and services, among other kinds of transactions.

Cash App is among the applications that have rendered traditional ways of sending money, such as checks and money orders, useless. Why would someone use a check to send funds, yet it takes so long to process? Cash App transfers and other similar platforms such as Venmo, PayPal, Payoneer, and Skrill allow you to send funds instantly to others. Therefore, you can transfer money for someone to deal with emergency cases using the platform.

Services Of Cash App

There are many services that one can get at the Cash App. They include the following:

i) Peer-to-peer money transfer

Peer-to-peer money transfer means sending funds to other Cash App users. You can transfer and receive funds instantly using the service and use the funds in transactions that require faster attention. When sending money, you require the user’s name, phone number, or the recipient’s email. Others also require the exact details when sending money to your account.

Interestingly, sending money via Cash App is free. However, when you utilize a credit card to fund your transfers, you must pay a 3% fee. Using a bank account or debit card is free. You need to know that you can add a bank or acceptable payment card to your Cash App account to use it for transactions. However, there is a way you can add money to Cash App without a debit card. For example, when someone sends you funds to your account, your balance will increase accordingly.

ii) Cryptocurrency

Cryptocurrency is a new type of currency that has hit the market by storm. As I mentioned earlier, Cash App allows you to buy and sell bitcoin. You can make some progress in the process if the coin price goes up. Again, you can send and receive Bitcoins from other users with just a few taps.

iii) Investing

The platform allows US residents users to trade stocks. Cash App added the features in 2020, which increased the platform’s usefulness. You can sell fractional shares of most publicly traded firms with a minimum of $1.

iv) Banking

The platform operates as a bank, and you can rely on it even if you do not have a bank. Apart from sending and receiving money from other users, you can move money to a bank account with just several taps on your phone.

Again, with the Cash Card, a customizable debit card from Cash App, you can withdraw funds at an ATM, buy goods and services online and at a physical store, as well as withdraw funds over the counter at a bank or credit union.

You can also enjoy Cash App automated clearing house (ACH) direct deposits. For example, one can transfer money from Chime to Cash App online. Chime is an online financial technology that offers banking services to users.

These are things you can do with a checking bank account. That’s why I am saying that the service gives you a complete banking experience.

The Procedure To Cash Out On Cash App

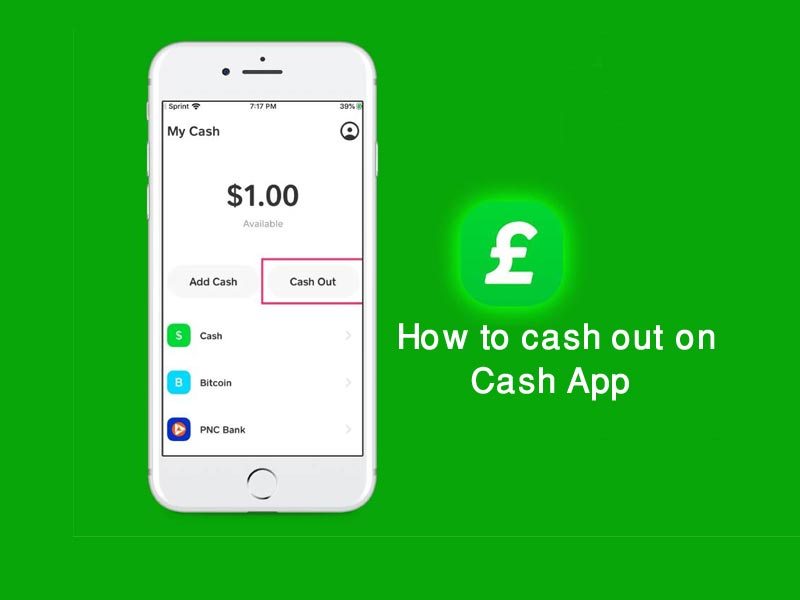

Cashing out refers to transferring funds from your Cash App to a bank account or debit card. Remember that you can add a debit card or bank account when opening your account. To cash out, you can follow the procedure below.

- Tap ‘Balance’ on your home screen.

- Hit ‘Cash Out’.

- Choose an amount and tap ‘Cash Out’.

- Select your preferred deposit speed.

- Confirm the transaction using your PIN or Touch ID.

You can deposit funds instantly to a debit card that links to your bank account or use the standard transfer that takes 1-3 business days. Standard transfers are free, but instant transfers cost you some fees. The instant transfers cost a 1.5% fee (with a minimum of $0.25). Cashing out to a bank account is not the only way to get money out of your account.

Almost all online platforms allow you to send money online. For your information, you can transfer money from Chime to a bank account. If you can recall, I mentioned that Chime is an online financial company that operates as a bank.

Is It Safe To Cash Out On Cash App

The platform is entirely safe as it uses various security layers to safeguard its users’ accounts. It uses a combination of encryption and fraud detection systems to help secure information and money. If they detect any fraud, they usually cancel the concerned transaction immediately.

Things you should be keen on are customer care impersonation. Again, the system usually sends you an OTP login code by SMS or email. You also require a PIN or Touch ID to authorize transactions.

Wrap Up

Cash App is a peer-to-peer money-sending service that allows you to send and receive money. It offers various banking, money transfers, and investing in cryptocurrencies. You can transfer funds to a bank or debit card.

When opening your account, you should add a debit or bank account to help you fund your transactions. The platform is safe as it uses various security layers to protect its users’ money.