The ability to move money from one platform to the other increases flexibility to financial services. It makes it easy to send payments to others as well as buy goods and services online. Various online platforms allow you to move money to other mobile wallets. Can you transfer money from Venmo to Paypal? Well, the answer to this question is No.

Venmo does not allow direct transfer of money to PayPal. However, there is an indirect method you can use to move money from your Venmo account. You will also find that you don’t need to transfer money from Venmo to another type of mobile wallet since Venmo supports similar transactions to those mobile wallets. You can pay online, transfer money to a bank, and also send money to others.

Additionally, most of these mobile wallets have debit cards that link to the main accounts. The cards allow you to withdraw money at an ATM, pay online, swipe at a physical store, and so on. Venmo has a MasterCard debit card that you can use for your transactions. But if you need to move money to PayPal for specific reasons, you will have to move it by all means.

What is Venmo?

Venmo is a mobile payment company that belongs to PayPal. The platform allows you to send or request money from your friends. It is an excellent digital avenue to carry out cashless transactions, especially during this Covid’19 period where you need to protect yourself from contracting Covid by all means.

The company started in 2009 under the leadership of Andrew Kortina and Iqram Magdon-Ismail. It works with Android and iOS, and you only need to download the app from the relevant application sites to get started. After signing up, you will be limited to sending up to $299.99 per person. When you confirm your account, your limit increases to $4,999.99 per person.

The institution has grown over the years and recorded 52 million users in 2020. That was a sharp rise from the 2019 40 million users. It shows how the purpose of the app, which was to help people split bills and boost each other in times of financial needs, is bearing fruits.

How does Venmo work?

It is crucial to understand how Venmo works before opening an account with them. Venmo is like a social app that deals with money transfers. As I had mentioned earlier, you can split bills and pay without the need for checks and credit cards.

To use Venmo, you need to sign up and get an account. Next, choose a funding source which may be a credit card or bank account. You can decide to use your Venmo balance to fund your transactions.

When your account starts working, you can pay others or request money with your Venmo account. When sending money, you add the recipient, the amount to send, and a note to explain the purpose of the funds. You can also move funds to a bank account for your savings or use other kinds of transactions that Venmo is not applicable. You can even transfer money to someone else’s bank account since Venmo allows you to add someone else’s bank or card account.

How do you set up a Venmo account?

Setting up a Venmo account is easy. First, download the Venmo app from either Google Play Store or App Store depending on the phone you are using. Next, choose your preferred method to sign up for your account. You can choose;

- Email address

Next, you need to verify your account using your phone number. Venmo will send you a four-digit code that you should enter in the space provided. Account verification ensures that no one can use your email or Facebook account to sign up for an account.

If everything is okay, Venmo will verify your account and advise you to add a profile photo. You can also choose to add your Facebook profile picture if you used Facebook to sign up for your account. A profile picture makes it easy for others to recognize you easily.

Lastly, Venmo will assign you a user name depending on the details you provide. Click on the tab ‘Done’ visible on the top right-hand corner of your screen. Also, allow Facebook to sync your friends’ list so that you can see who is on Venmo. Venmo will also request to sync your contacts, and you may choose to allow it as well. If you have a Siri device with you, you can choose to integrate it with your Venmo account.

After that, choose whether to receive notifications from Venmo about products, news, and new features related to your account. At this point, your Venmo account is ready for transactions.

How to transfer money from Venmo To Paypal

Now let’s go back to our main agenda on how you can transfer money from Venmo to PayPal. Despite Venmo being a PayPal product, it is surprising to note that it does not support the transfer of funds to PayPal! However, there is a way you can avail money from Venmo to PayPal.

Both Venmo and PayPal allow the transfer of money to and from a bank account. The trick we can use is now utilizing a bank account which will act as a bridge between Venmo and PayPal. Also, you should link the bank to both Venmo and PayPal. The following procedure will enable you to move money successfully from Venmo to PayPal.

1) Transfer money from Venmo to your bank account

To transfer money from Venmo to a bank account, you should follow the steps below.

- Enter the amount to move to your bank account

- Select “Instant” or “1-3 Biz Days” and select your bank account

- Confirm your details, and tap the “Transfer” button

The instant transfer attracts a small fee of 1% (with a minimum of $0.25 and a maximum of $10). Funds reflect in your bank account within 30 minutes. The 1-3 Biz Days option is free, but you have to wait for 1-3 business days for the transaction to reflect in your bank account.

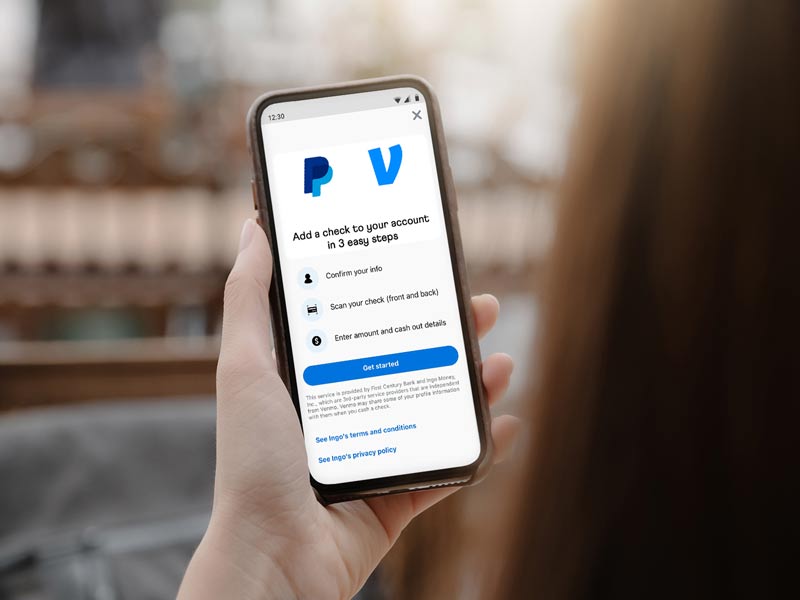

2) Transfer money from your bank account to PayPal

Once money enters your bank account that links to PayPal, you can then transfer it to your PayPal account. To add money to a PayPal account from your bank, follow the steps below.

- Click on Wallet

- Select Transfer Money

- Tap on Add money to your balance

- Choose your bank account and enter the amount to add to your PayPal account from your bank account

- Click Add

Wait for the balance to reflect on your account. You will have successfully transferred money from your Venmo account to PayPal. Even when you want to transfer money from Venmo to Cash App, you will still use the same procedure.

You can also use a debit card as a bridge to transfer money from Venmo to PayPal. The card must be compatible with both PayPal and Venmo. That means that you do not need a bank account to facilitate the transfer of money from your Venmo account to Paypal.

How do I add my bank account to Venmo and PayPal?

Before using a bank account to fund your transactions or to withdraw money to Venmo or PayPal, you have to link or add the bank account to the digital wallets. To connect a bank account to Venmo, the steps below will help.

- Tap on the “☰” icon at the top of the screen

- Tap on “Settings”

- Select “Payment Methods”

- Tap on “Add a bank or card…”

- Select “Bank”

- Select a verification method

Once Venmo verifies your bank details, then your account will be among the linked banks. For you to add a bank to PayPal, the following steps will be of importance.

- Navigate to Wallet

- Tap on Add a card or bank account.

- Select Add a bank account.

- Enter the ‘Sort Code’ and then your ‘Account Number.’

- Review the information and tap Agree to add.

Adding money to either of the two helps me withdraw money to my bank account, where I can withdraw money with my account number at a bank’s branch or carry out other transaction types online.

Can I transfer money from Venmo to a debit card?

You can transfer money to a debit card instantly so that the funds reflect in the debit card account within 30 minutes. Venmo supports Visa and Mastercard debit cards. Venmo itself has a Mastercard debit that you can use for various transactions.

Before transferring money to a debit card, you need to link your card using the steps below.

- Tap the “☰” icon at the top of your screen

- Under “Settings,” select “Payment Methods.”

- Select “Add bank or card…”

- Select “Card”

- Add your card information either manually or using your phone’s camera

Adding money to a card that links to your bank account is an indirect way to recharge your bank account. You can thus spend money from your account using the card or the bank details. You can send money with your checking account number instantly to other people when logged in to your bank account online.

Bottom line

Venmo is a mobile money service that belongs to PayPal. It helps people to send each other money as well as share bills together. You can even request money from your friend within the app.

Even though Venmo is a PayPal product, you cannot move money directly from Venmo to PayPal. However, you can use your bank account or debit card to facilitate the transfer.